Retiree Self-Service

The Tennessee Consolidated Retirement System (TCRS) created the Retiree Self-Service site to allow you convenient access 24 hours a day, 7 days a week to your retirement account information. It enables you to view your personal information, benefit payment history, account summary, and other relevant details specific to your account. In addition, you can update your address and contact information on record with our office, as well as change your tax withholding or direct deposit information. This state-of-the-art technology tool provides you with powerful access to your personal retirement account.

1.1 Registering for Retiree Self-Service

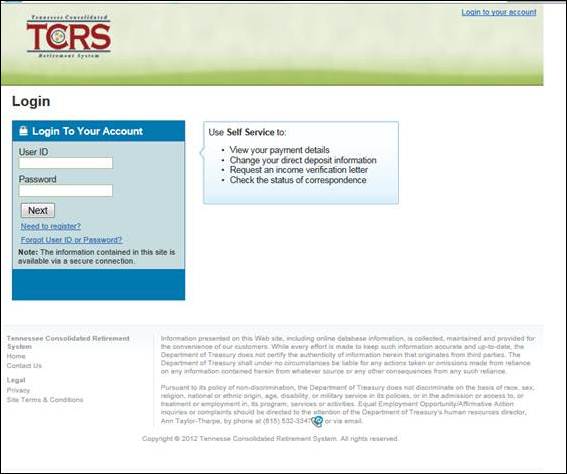

The Login screen is the starting point for you to access the Retiree Self-Service website, but before you login for the first time, you must register. To register for a Retiree Self-Service account, you will need to follow the steps outlined here and enter all required information on each screen. If you do not enter required information, you will not be able to successfully register on the Retiree Self-Service website. If you incorrectly enter information, such as your Social Security Number, birth date, or Net Pay, five consecutive times, the registration process will be locked. If your registration is locked, you will need to contact TCRS to unlock it.

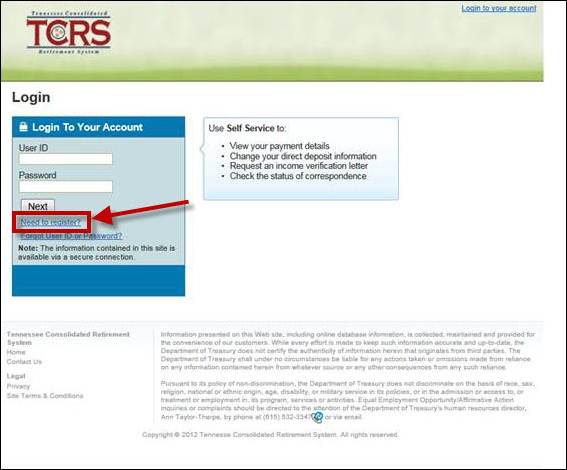

Step 1

— Start by clicking ![]() on the Login

screen.

on the Login

screen.

Step 2 — Enter your Social Security Number

and Birth Date, then click ![]() to continue.

to continue.

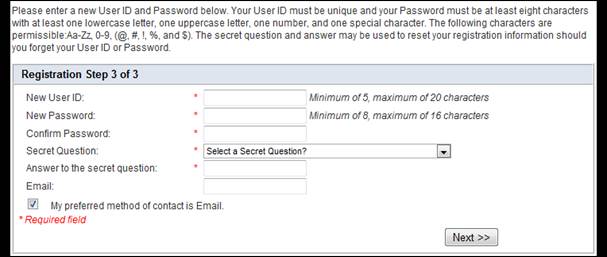

Step 3 — Enter

your net pay from your most recent payment. This should be the amount

deposited into your account for your last benefit payment. Click

![]() to

continue.

to

continue.

Step

4 — Enter a user ID and password,

following the guidelines displayed on the screen. Your email address

is collected in order to send confirmation of your registration. Select

a secret question and answer which are used to verify your identity in

the event you forget your password. Click ![]() to

continue.

to

continue.

Step

5 — The screen that appears confirms your registration. Click ![]() to

go to the Retiree Self-Service home page. If the retiree has an email

address on record, the Self-Service Registration email is sent to the

retiree.

to

go to the Retiree Self-Service home page. If the retiree has an email

address on record, the Self-Service Registration email is sent to the

retiree.

After you register for a Retiree Self-Service account, you can use your user ID and password to log in to the Retiree Self-Service website 24 hours a day, 7 days a week to access your account information. The following steps describe how to log into the Retiree Self-Service website.

Note: If you try to log in five consecutive times with the incorrect user ID, password, or secret question your account will be locked. If your account is locked, you will need to contact TCRS to unlock it.

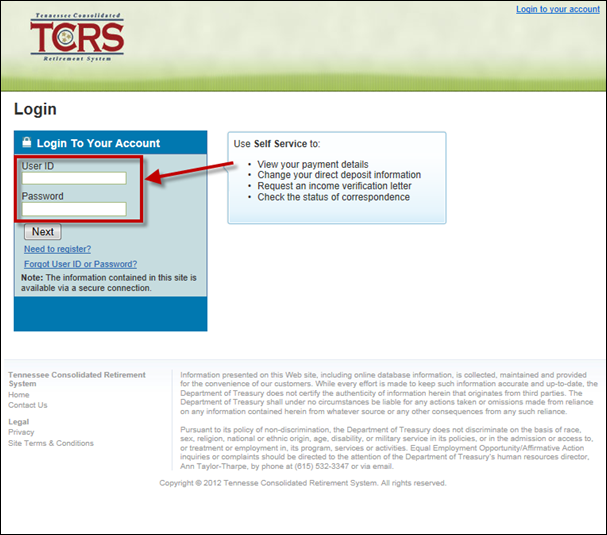

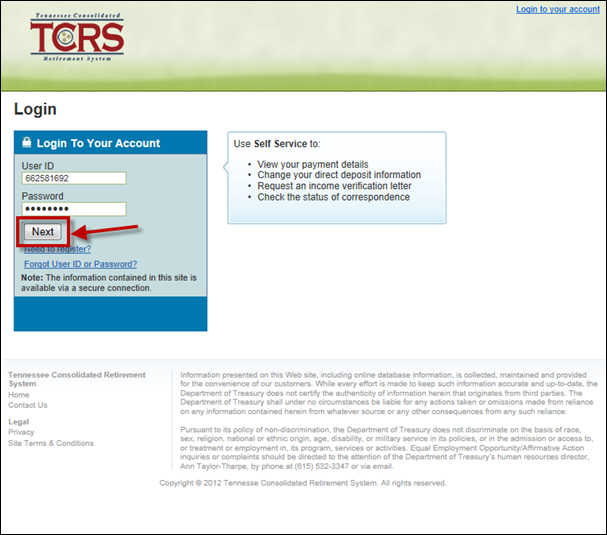

Step 1 — From the Retiree Self-Service Login screen, enter your user ID and password into the fields.

Step 2 — Click ![]() .

.

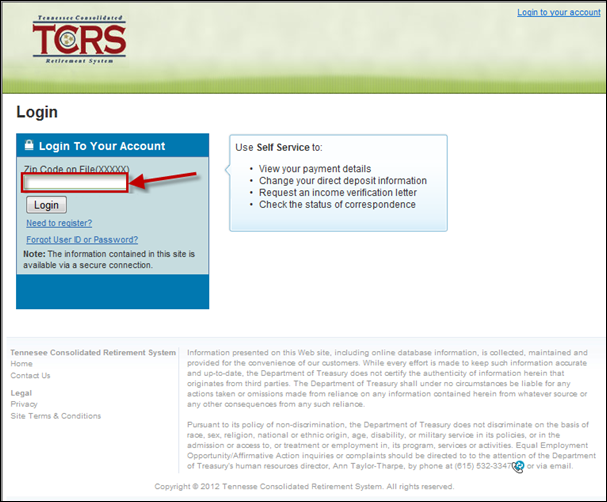

Step 3 — Answer the security question. The security questions display randomly and can be one of the following four:

· Last four digits of your SSN

· Date of Birth (MMDD)

· Year of Birth (YYYY)

· ZIP Code on record

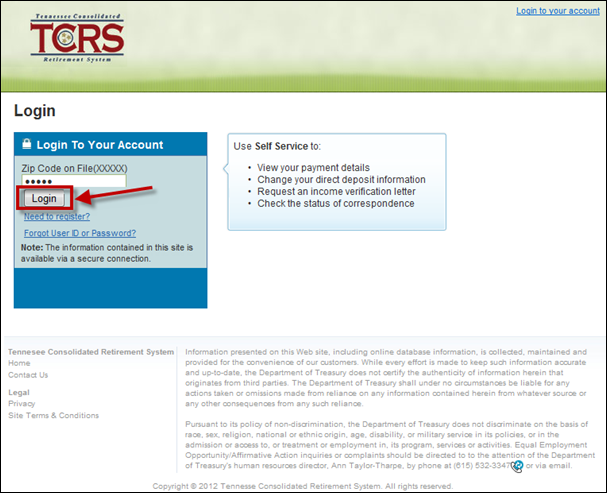

Step 4 — Click ![]() .

.

Step 5 — The Retiree Self-Service home page displays.

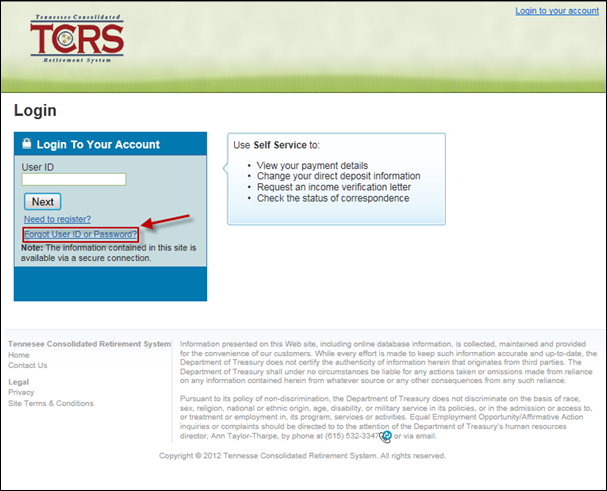

1.3 Recovering a Lost User ID or Password

If you forget your user ID or password, you are able to obtain a new one by clicking on the Forgot Password / User ID link on the Login screen and following these steps. You must enter all required information on each screen. If you do not enter required information, you will not be able to successfully recover your lost user ID or password.

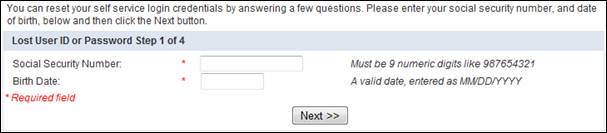

Step 1

— Enter your Social Security Number and

birth date, then click ![]() .

.

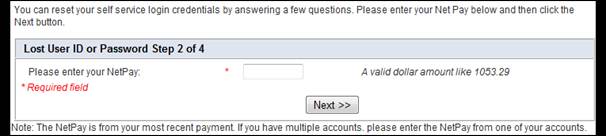

Step 2

— Enter the net pay of your most recent

payment, then click ![]() .

.

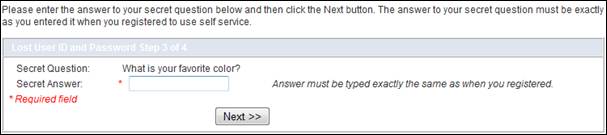

Step 3

— Answer the secret question, then click

![]() .

.

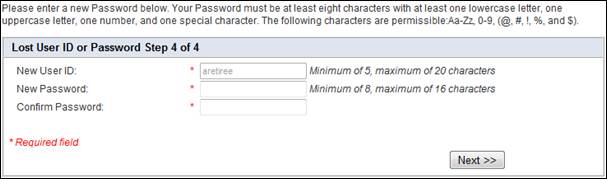

Step 4 — Your User ID displays. Create a new password.

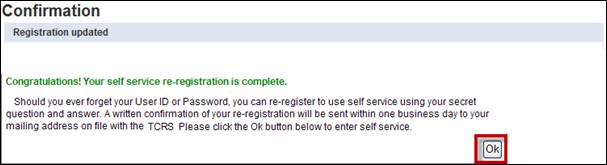

Step 5 — The screen

that appears confirms the update to your registration. If you have

an email on record with TCRS, the user ID / Password Change email is also

sent to you. Click ![]() .

.

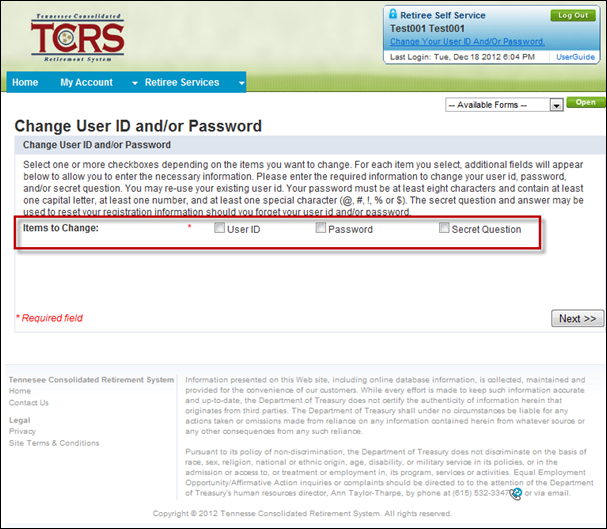

1.4 Changing a User ID or Password

If you want to change your user ID or password, you can do so from the Retiree Self-Service home page. You must enter all required information on each screen. If you do not enter required information, you will not be able to successfully change your lost user ID or password.

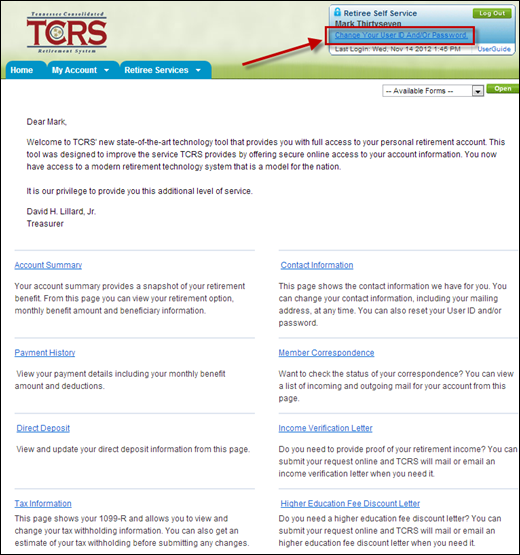

Step 1 — After logging in to the Retiree Self-Service website (see Section 1.2), click the Change Your User ID And / Or Password link.

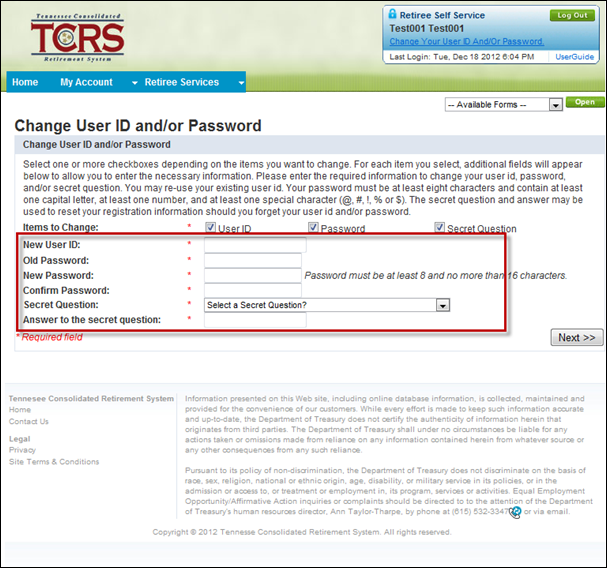

Step 2 — Select the checkbox for the items you want to change. You can select multiple checkboxes to change more than one item.

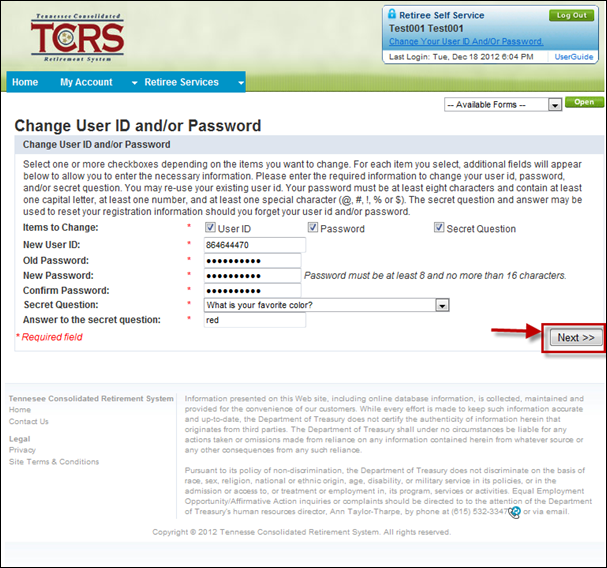

Step 3 — Enter the required information. The required information changes based on the selection made in Step 2.

· If you select the User ID checkbox, enter a new user ID

· If you select the Password checkbox, enter the old password, new password, and confirm the new password

· If you select Secret Question checkbox, select a question from the drop down menu and enter an answer to the secret question

Step 4 — Click ![]() .

.

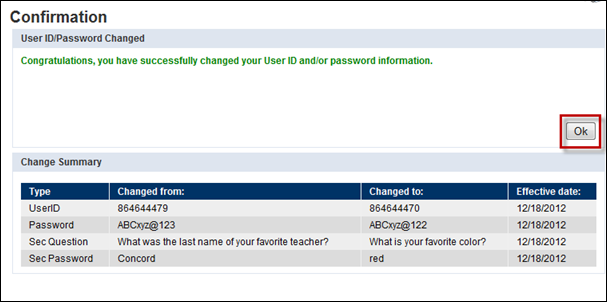

Step 5 — The screen that appears confirms

your changes. Click ![]() to

return to the Home screen.

to

return to the Home screen.

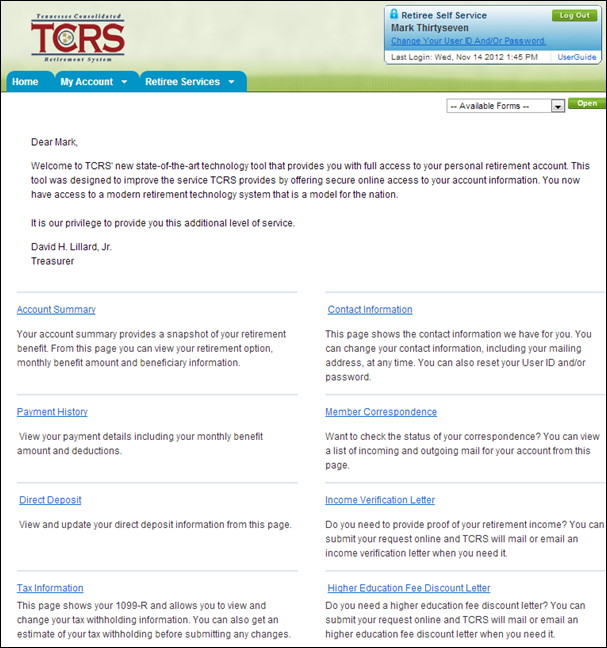

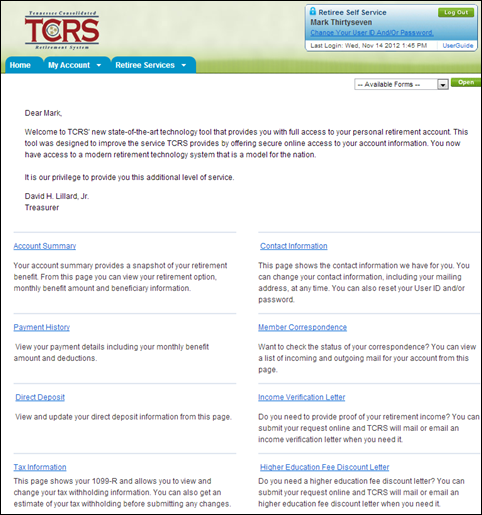

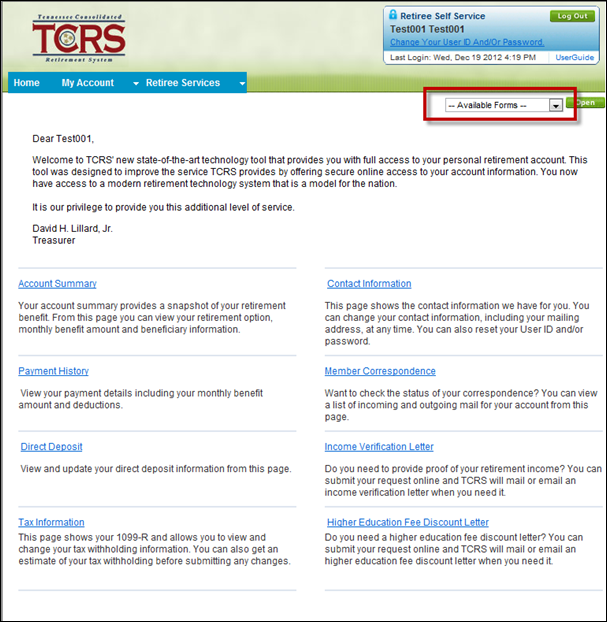

After logging into the Retiree Self-Service website (see Section 1.2 Logging In), the Home screen displays.

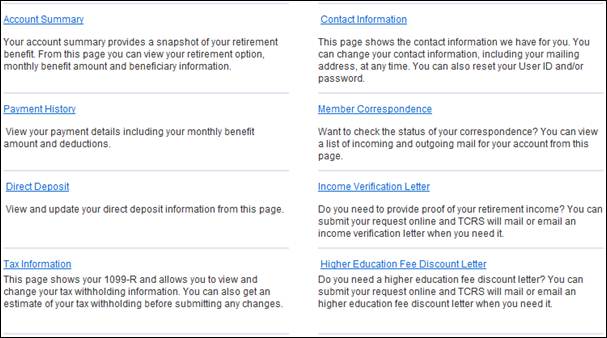

From the Home screen, you can navigate to different sections of the website by clicking on the links in the bottom half of the screen.

You are also able to access these screens from the drop down menus at the top of the Home screen. These menus are available on every screen within the Retiree Self-Service website.

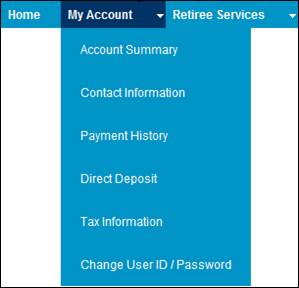

The Account Summary screen shows information regarding the benefits you are receiving. From this screen, you can view your direct deposit information, current federal tax withholdings, and any other deductions.

The following steps describe how to navigate to the Account Summary screen. You must be logged into the Retiree Self-Service website to follow the steps in the sections that follow.

Step 1 — On the Home screen, either select Account Summary from the My Account drop down menu or click the Account Summary link.

|

|

Step 2 — The Account Summary screen displays. You are able to view specific information regarding benefits that you are receiving. You are also able to change and update your tax withholdings and direct deposit information.

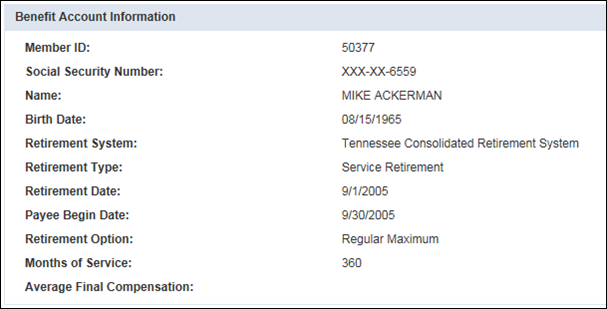

The Benefit Account Information section shows basic information regarding the benefit being received, including your member ID, the retirement system from which the benefit is paid, the type of account, the account effective date, your retirement option and total years of service.

The Monthly Benefit Information section shows the gross and net amount of the benefit, along with the amounts that are being deducted. If any changes are made to the tax information, the net amount of the benefit received would change as well.

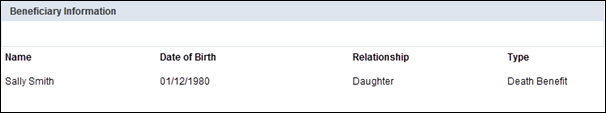

The Beneficiary Information section displays all your current beneficiary designations.

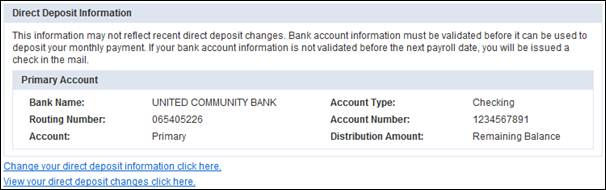

If you have elected to have your benefit direct deposited, the Direct Deposit Information section shows those details.

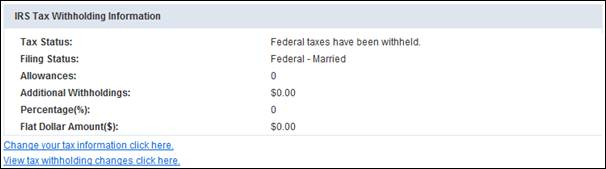

The IRS Tax Withholding Information section shows the federal tax information for the benefit. You will be able to change your tax elections by clicking on the Change your tax information click here link.

If there are any other deductions being withheld from the benefit, they display in the Deduction Information section.

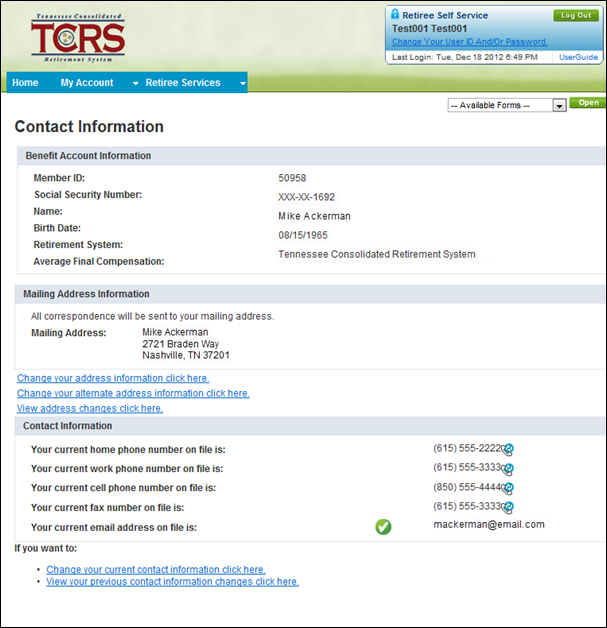

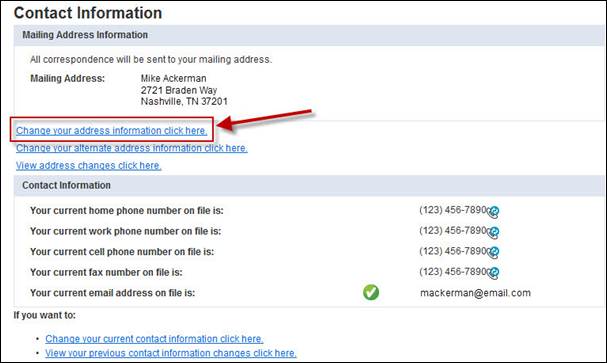

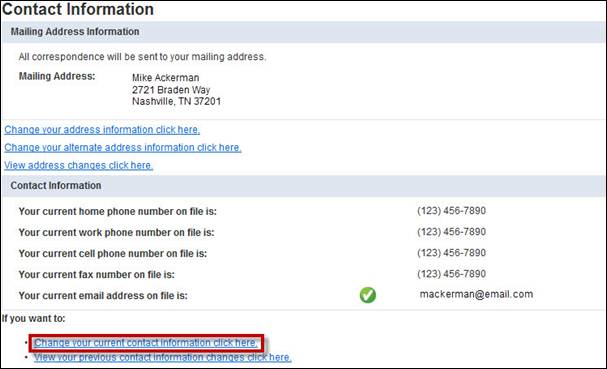

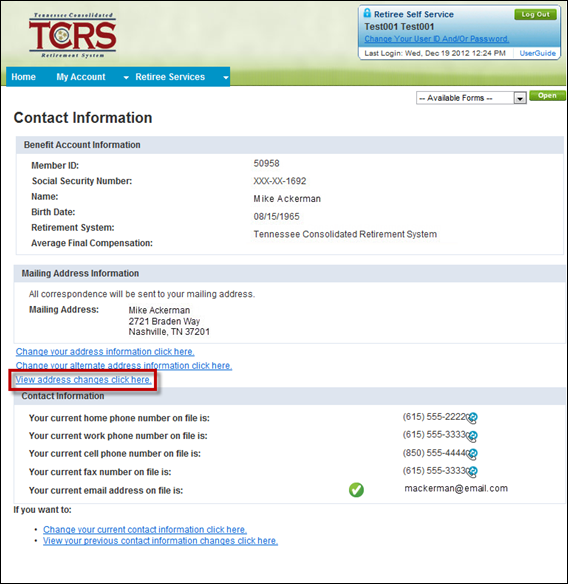

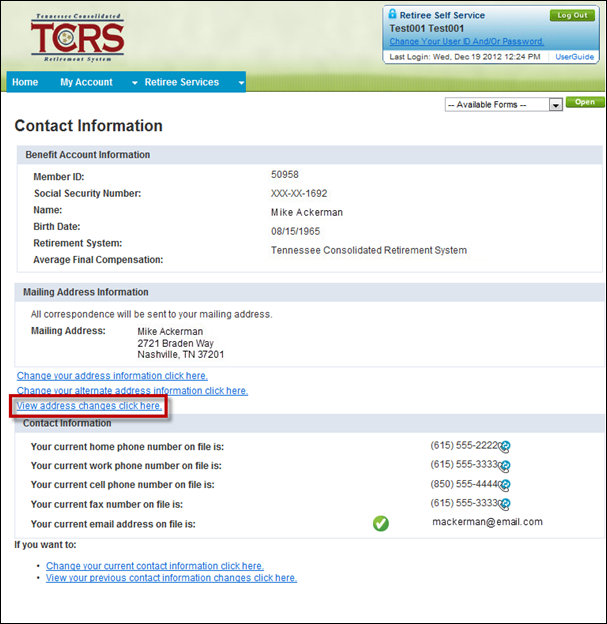

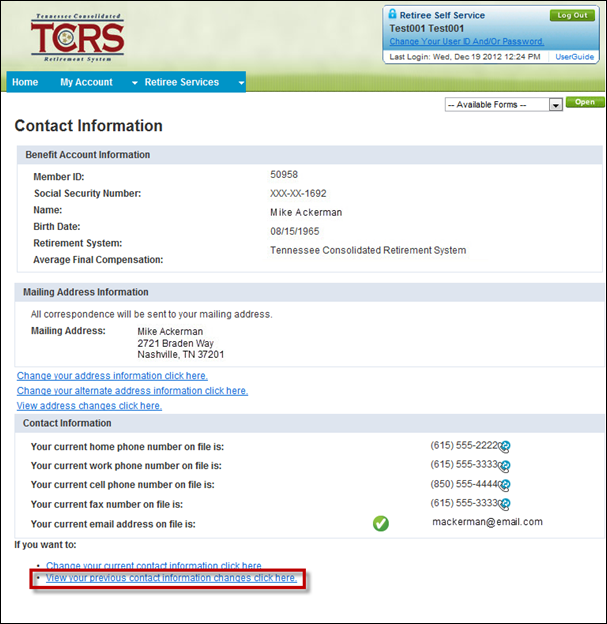

The Contact Information screen displays the contact information, such as address, phone number, or email address, that is on record with TCRS.

4.1 Navigating to the Contact Information Screen

The following steps describe how to navigate to the Contact Information screen. You must be logged into the Retiree Self-Service website to follow the steps in the sections that follow.

Step 1 — On the Home screen, either select Contact Information from the My Account drop down menu or click the Contact Information link.

|

|

Step 2 — The Contact Information screen displays.

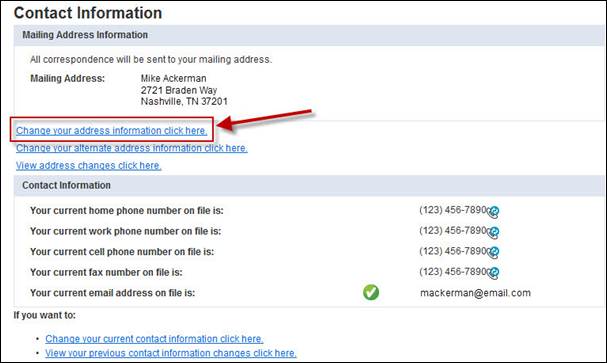

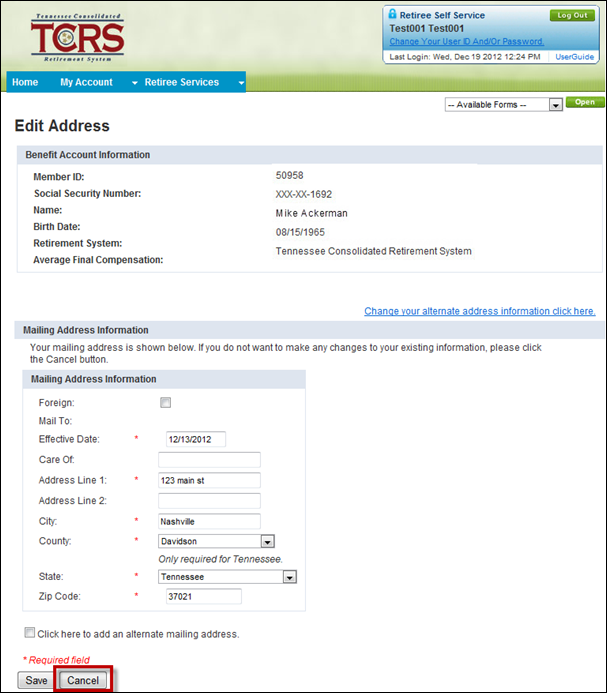

4.2 Changing Your Contact Information

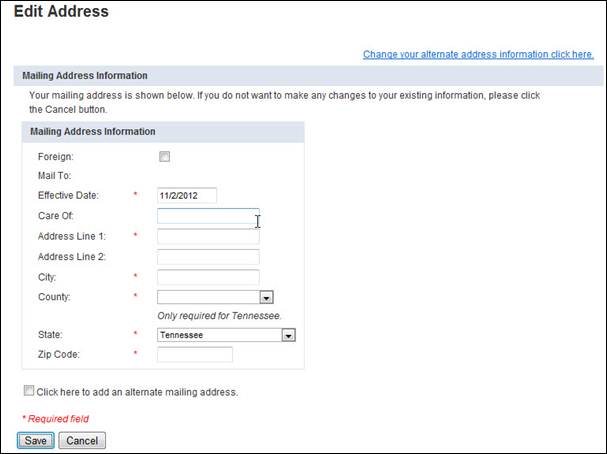

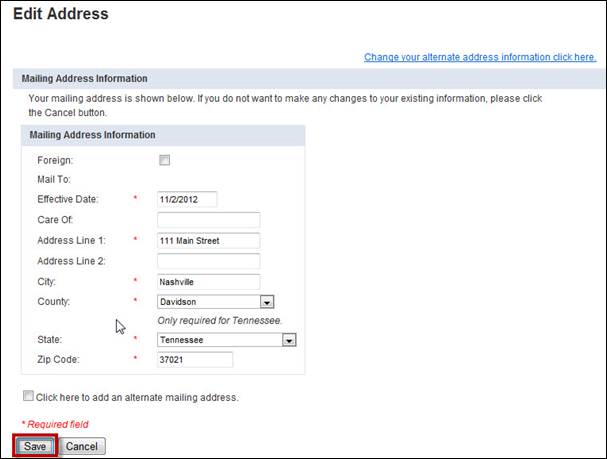

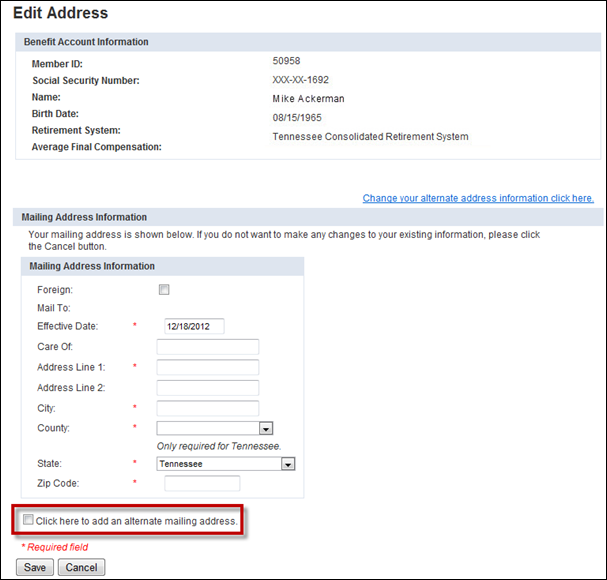

Follow the directions in Section 4.1, Navigating to the Contact Information Screen, then follow the steps below to change your contact information. You must enter all required information on each screen. If you do not enter required information, you will not be able to successfully change your contact information.

Step 1 — Click the Change your address information click here link.

Step 2 — In the screen that appears, enter your new address.

Step 3 — Click ![]() .

.

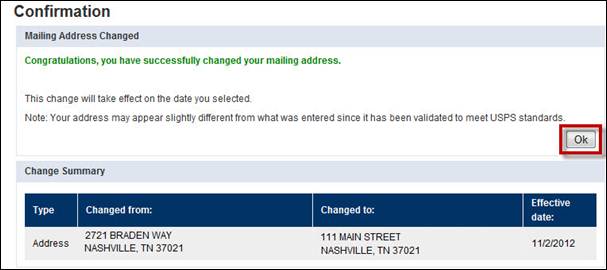

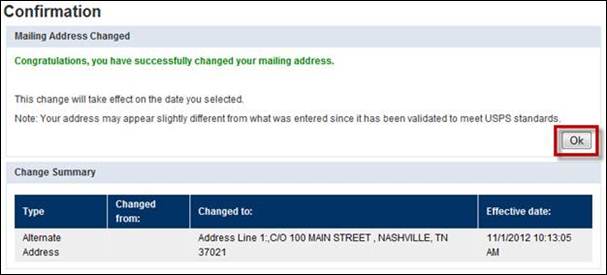

Step 4 — The screen

that appears confirms the change in mailing address. Click ![]() to view your pending

address changes.

to view your pending

address changes.

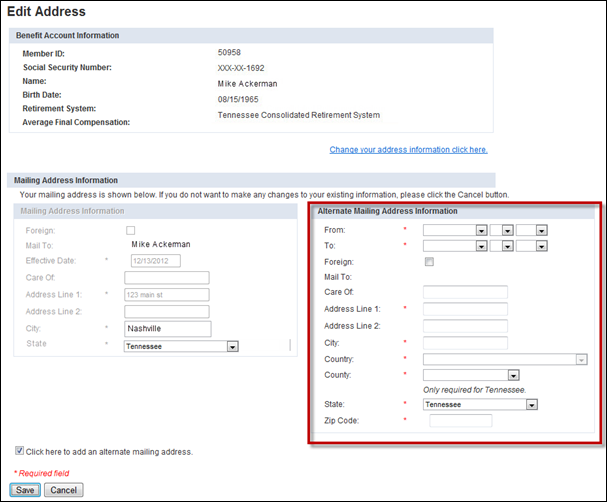

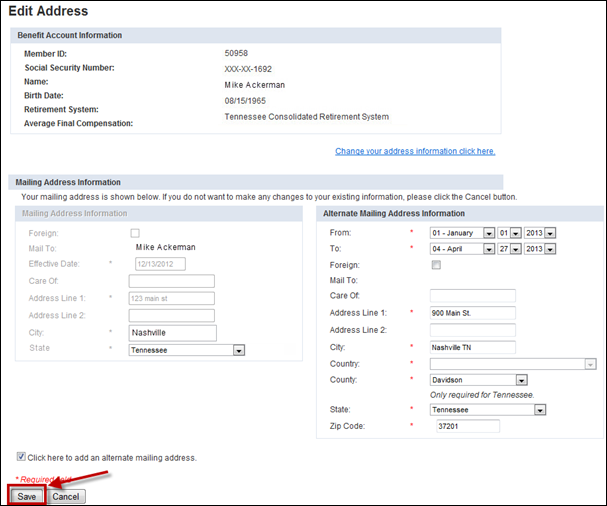

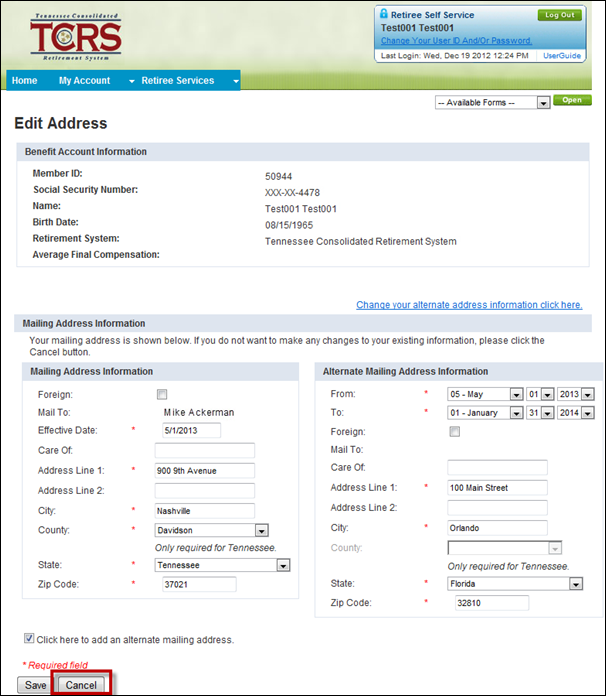

4.3 Adding an Alternate Address

An alternate address is a secondary mailing address that can be used temporarily or for recurring periods of time. For example, if you often live at a different residence for several months per year, an alternate address should be on record with TCRS. Follow the directions in Section 4.1, Navigating to the Contact Information Screen, then follow the steps below to add an alternate address. You must enter all required information on each screen. If you do not enter required information, you will not be able to successfully add an alternate address.

Step 1 — Click the Change your current address information click here link.

Step 2 — Select the Click here to add an alternate address checkbox.

Step 3 — In the screen that appears, enter your alternate address.

Step 4 — Click ![]() .

.

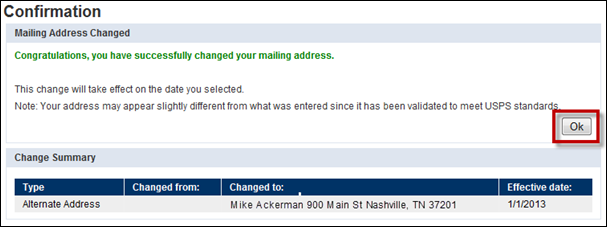

Step

5 — The screen that appears confirms the adding of your alternate

mailing address. Click ![]() to

view your pending address changes.

to

view your pending address changes.

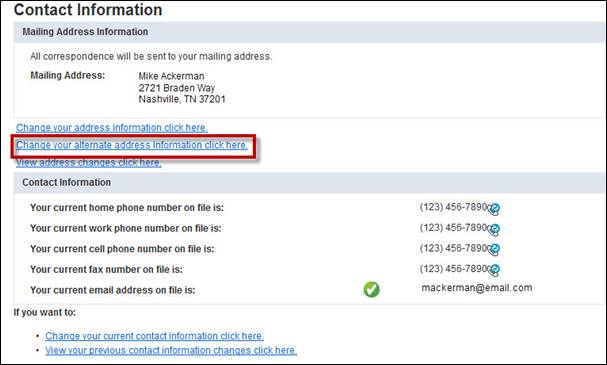

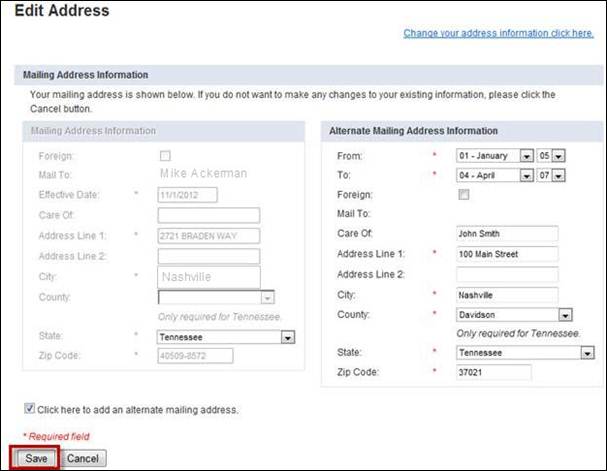

4.4 Changing Your Alternate Address

Follow the directions in Section 4.1, Navigating to the Contact Information Screen, then follow the below steps below to change an existing alternate address. You must enter all required information on each screen. If you do not enter required information, you will not be able to successfully change your alternate address.

Step 1 — Click the Change your alternate address information click here link.

Step 2 — On the

screen that appears, change your alternate mailing address, specify the

date range for when it is effective and click ![]() .

.

Step

3 — The screen that appears confirms the changes to your alternate

address. Click ![]() to view your pending

address changes.

to view your pending

address changes.

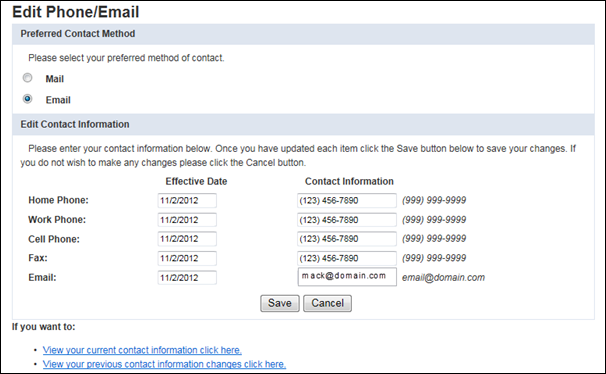

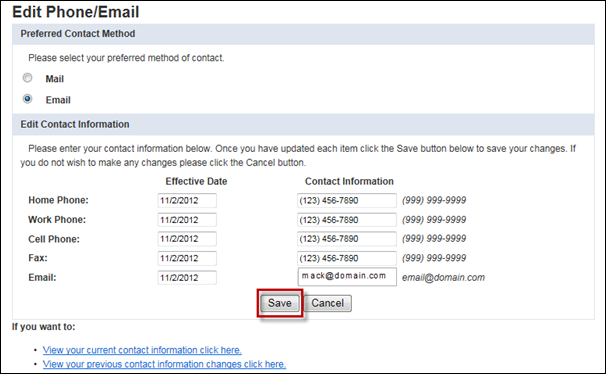

4.5 Changing Your Contact Information (Phone Number / Email Address)

Follow the directions in Section 4.1, Navigating to the Contact Information Screen, then follow the steps below to change your contact information. You must enter all required information on each screen. If you do not enter required information, you will not be able to successfully change your contact information.

Note: TCRS will contact you by phone only if other contact methods have been unsuccessful.

Step 1 — Click the Change your current contact information click here link.

Step 2 — Update your phone number and email information. Enter an effective date. The effective date of the change will automatically default to the current date. If you choose Email for your preferred method of contact, you will receive all correspondence via email, except your 1099R which is required by federal law to be mailed to your home address.

Step 3 — Click ![]() .

.

Step

4 — The screen that appears confirms the change to your contact information.

Click ![]() to

return to the Contact Information screen.

to

return to the Contact Information screen.

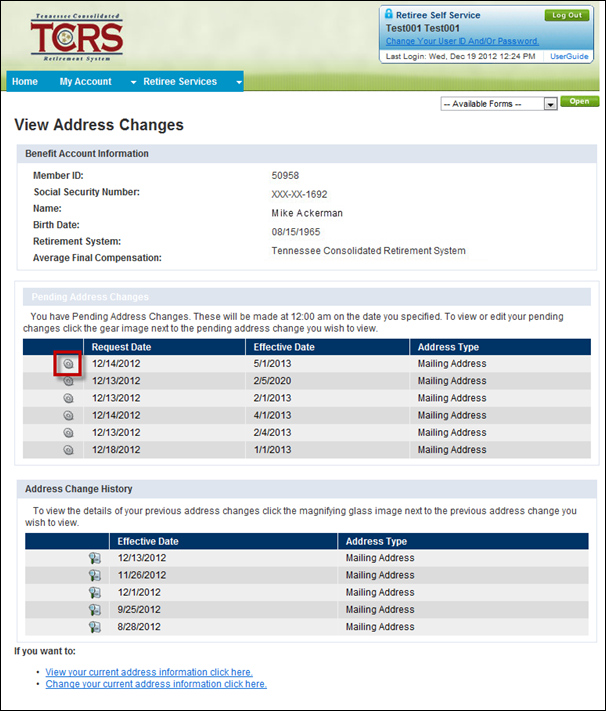

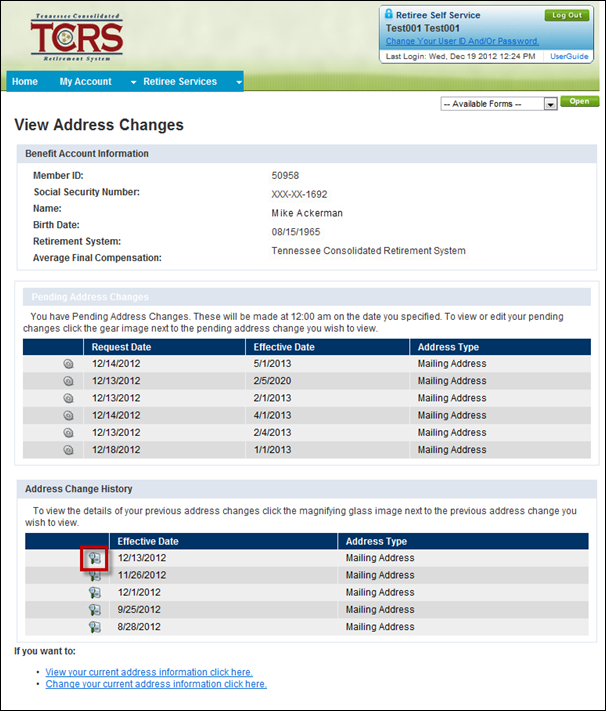

4.6 Viewing Pending Address Changes

You can view and edit your pending address changes using the Contact Information screen. Follow the directions in Section 4.1, Navigating to the Contact Information Screen, then follow the steps below to view pending address changes.

Step 1 –- Click the View address changes click here link.

Step 2 –- The screen

that appears displays your benefit account information, pending address

changes, and address change history. Click ![]() to

view the details of a pending address change.

to

view the details of a pending address change.

Step 3 –- The Edit

Address screen displays with the changes made for that pending address

change. You can make changes, then click ![]() or

click

or

click ![]() ,

which returns you to the Contact Information screen.

,

which returns you to the Contact Information screen.

4.7 Viewing Address Change History

You can view the history of the changes made to your mailing address, using the Contact Information screen. Follow the directions in Section 4.1, Navigating to the Contact Information Screen, then follow the steps below to view your address change history.

Step 1 –- Click the View address changes click here link.

Step 2 –- The screen

that appears displays your benefit account information, pending address

changes, and address change history. Click ![]() to

view the details of an address change.

to

view the details of an address change.

Step 3 –- The Edit

Address screen displays with the changes made for that address change.

You can make changes, then click ![]() or

click

or

click ![]() ,

which returns you to the Contact Information screen.

,

which returns you to the Contact Information screen.

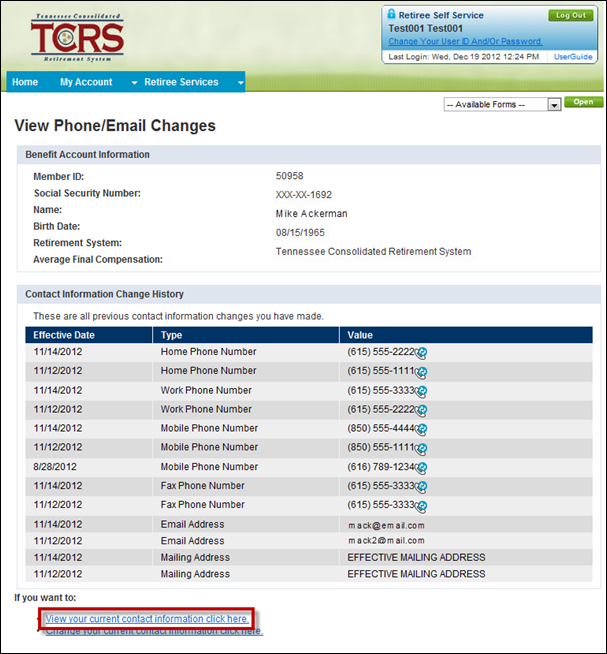

4.8 Viewing Previous Contact Information Changes

You can view previous contact information changes you entered using the Contact Information screen. Follow the directions in Section 4.1, Navigating to the Contact Information Screen, then follow the steps below to view your previous contact information changes.

Step 1 –- Click the View your previous contact information changes click here link.

Step 2 –- A history of contact information changes displays. Click the View your current contact information click here link to return to the Contact Information screen.

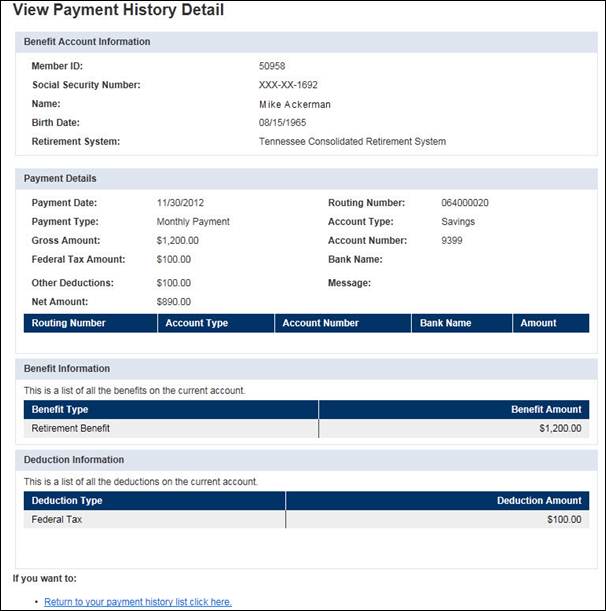

Payment Historyscreen shows information regarding the benefit that you are receiving. From this screen, you can view information regarding individual payments that you have received in the past, along with the amount of deductions and taxes that were withheld from the benefit.

Note: you can only view your payment history back to June 6, 2011. If you need payment history prior to that date, TCRS can provide this for you.

The following steps describe how to navigate to the Payment History screen. You must be logged into the Retiree Self-Service website to follow the steps in the sections that follow.

Step 1 –- On the Home screen, either select Payment History from the My Account drop down menu or click the Payment History link.

|

|

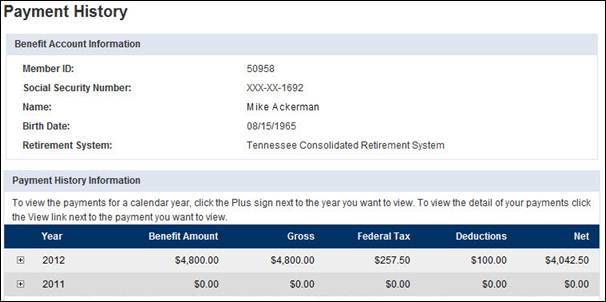

Step 2 — The Payment History screen displays.

The Benefit Account Information section shows the basic information regarding the benefit being received. Here you see your member ID, partial Social Security Number, name, birth date and the retirement system from which the benefit is paid.

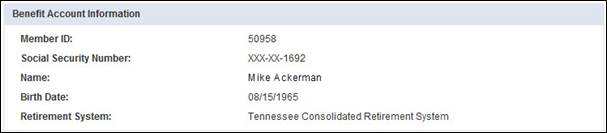

The Payment History Information section of this screen shows a summary of the benefits that you have received broken down by year.

To view individual

payments received, click ![]() next to the year you

would like to view. This expands the year section to show all benefits

that were received during that year.

next to the year you

would like to view. This expands the year section to show all benefits

that were received during that year.

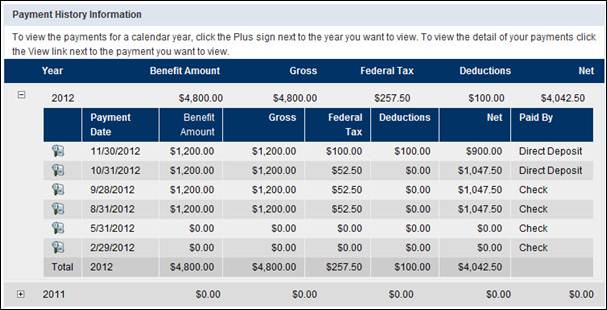

To view more specific

information on an individual payment that has been received, click

![]() next to the payment that you would

like to view. This displays another screen that shows you more detailed

information on that benefit payment.

next to the payment that you would

like to view. This displays another screen that shows you more detailed

information on that benefit payment.

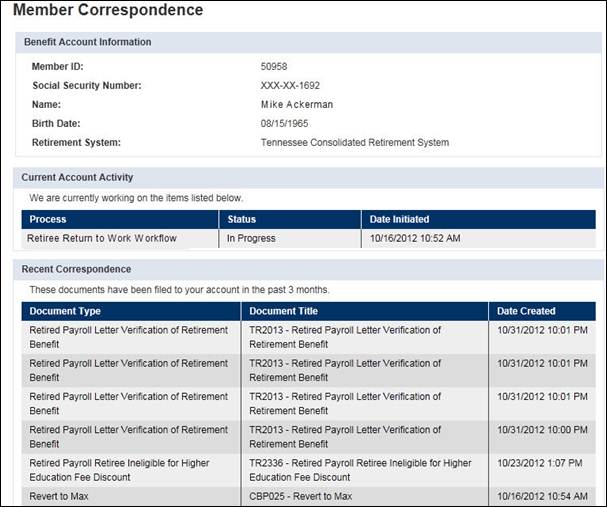

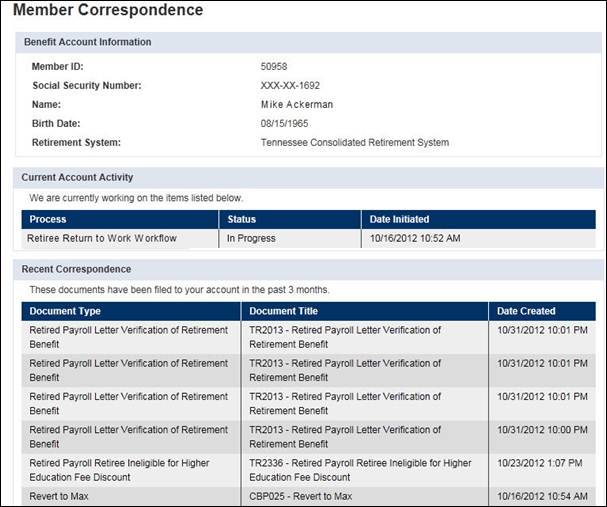

The Member Correspondence screen allows you to view a list of items, such as verification of retirement benefit or change in beneficiary, that are currently being worked on by TCRS along with any documents that have been sent to you recently. You can view a list of correspondence sent or received by TCRS within in the past 3 months.

6.1 Navigating to the Member Correspondence Screen

The following steps describe how to navigate to the Member Correspondence screen. You must be logged into the Retiree Self-Service website to follow the steps in the sections that follow.

Step 1 –- On the Home screen, either select Member Correspondence from the Retiree Services drop down menu or click the Member Correspondence link.

|

|

Step 2 — The Member Correspondence screen displays.

6.2 Viewing Available Information about Member Correspondence

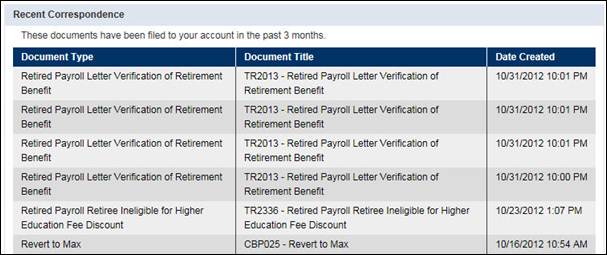

You can request copies of correspondence items sent to you by contacting TCRS. From the Member Correspondence screen, you are able to see a list of forms and correspondence that have been filed to your account in the past 3 months.

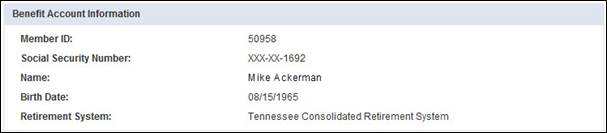

The Benefit Account Information section shows basic information regarding the benefit being received, including your member ID, partial Social Security Number, name, birth date and the retirement system from which the benefit is paid.

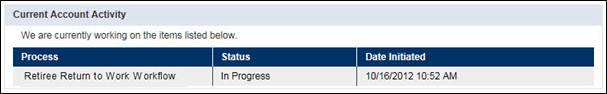

The Current Account Activity section shows a list of items that are currently being worked on by TCRS staff. The Process column lists work items that TCRS staff is working on, such as Return to Work or Member Legal Document Update. The Status column shows the status of that work item. The Date Initiated column shows the date and time that the work item was started.

The Recent Correspondence section displays any documents that TCRS has on record for you.

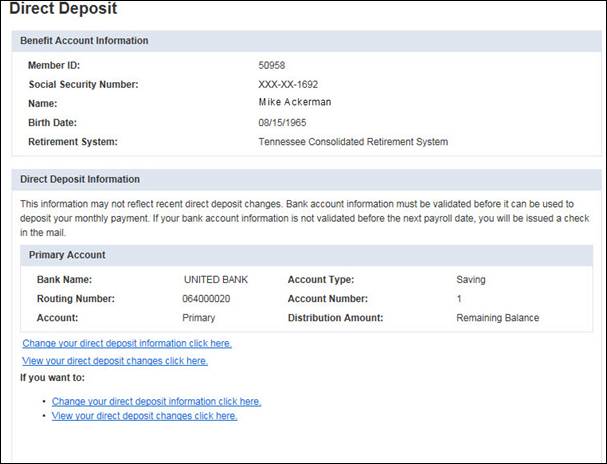

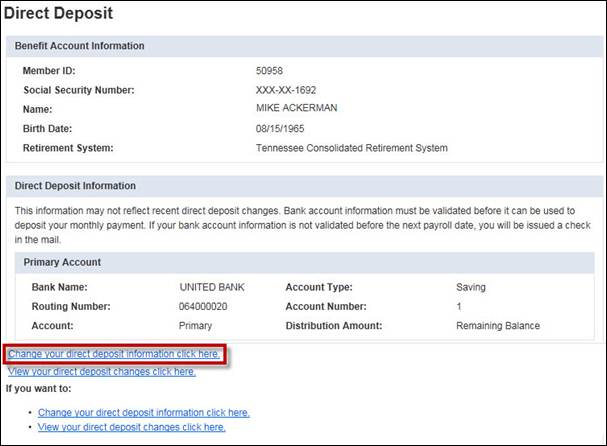

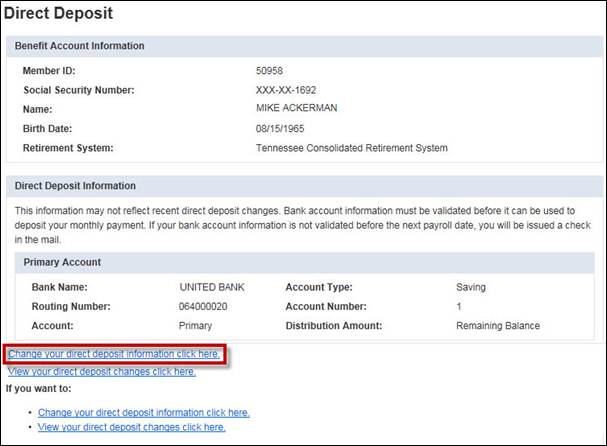

The Direct Deposit screen shows information such as account type, bank routing number, and bank account number of the bank that is currently on record with TCRS for the direct deposit of your benefit payment. You are able to change your bank account information for direct deposit from this screen instead of sending a form to TCRS.

Note: If you have more than one benefit account, you will need to change the direct deposit information on each account separately.

7.1 Navigating to the Direct Deposit Screen

The following steps describe how to navigate to the Direct Deposit screen. You must be logged into the Retiree Self-Service website to follow the steps in the sections that follow.

Step 1 –- On the Home screen, either select Direct Deposit from the My Account drop down menu or click the Direct Deposit link.

|

|

Step 2 — The Direct Deposit screen displays.

7.2 Viewing Your Direct Deposit Information

From the Direct Deposit screen, you can view the direct deposit information that is currently on record with TCRS for your benefit account(s).

The Benefit Account Information section of the screen shows the basic information regarding the benefit being received, including your member ID, partial Social Security Number, name, birth date and the retirement system from which the benefit is paid.

If you have elected to have your benefit direct deposited, the Direct Deposit Information section shows the information for the bank where the benefit is deposited.

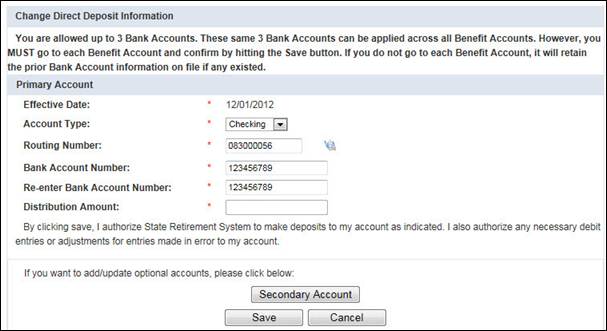

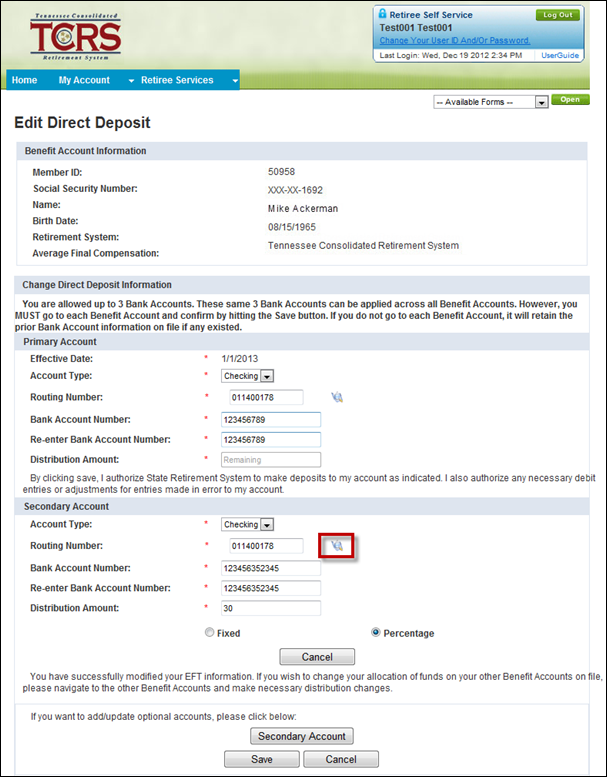

7.3 Changing Your Direct Deposit Information

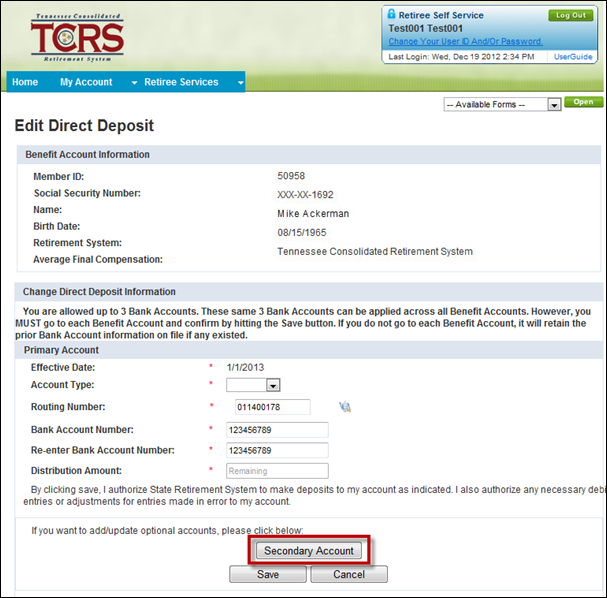

Follow the directions in Section 7.1, Navigating to the Direct Deposit Screen, then follow the steps below to change your direct deposit information. You must enter all required information on each screen. If you do not enter required information, you will not be able to successfully change your direct deposit information.

Step 1 –- Click the Change your direct deposit information click here link.

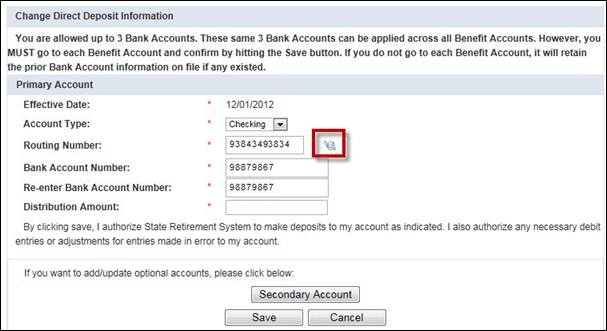

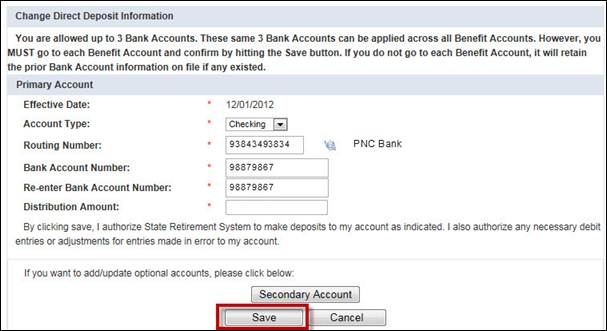

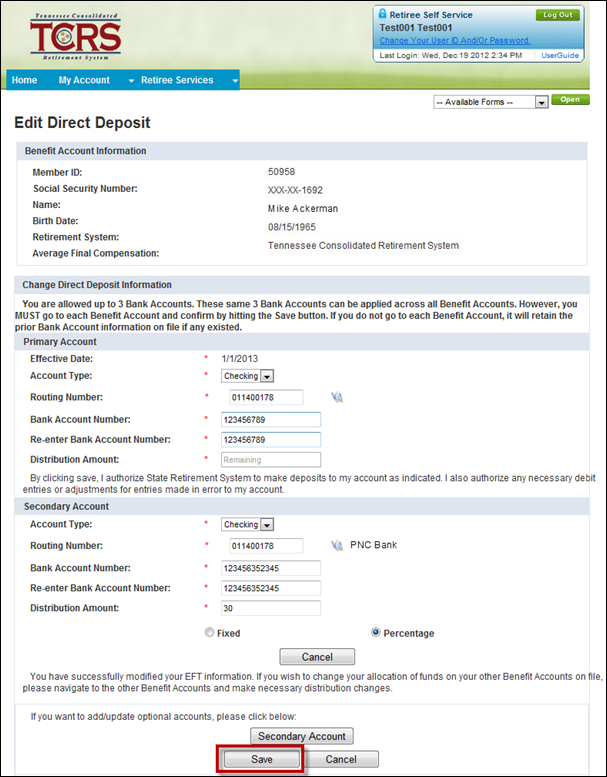

Step 2 — In the screen that appears, your current direct deposit information displays. Enter your new direct deposit information into the required fields.

Step 3 — Click ![]() to

verify the routing number entered matches the bank for the direct deposit.

to

verify the routing number entered matches the bank for the direct deposit.

Note:

If you incorrectly entered your routing

number, the ![]() message

displays next to the Routing Number field. You will not be

able to save the bank account information without entering the correct

routing number.

message

displays next to the Routing Number field. You will not be

able to save the bank account information without entering the correct

routing number.

Step 4 — To accept

the change in your direct deposit information, click ![]() .

.

Note: There are three buttons at the bottom of the screen.

· The

![]() saves

the bank account information you entered as a secondary account.

saves

the bank account information you entered as a secondary account.

· The

![]() saves

the bank account information you entered as your primary account.

saves

the bank account information you entered as your primary account.

· The

![]() does

not save the information you entered and directs you to the Direct

Deposit screen.

does

not save the information you entered and directs you to the Direct

Deposit screen.

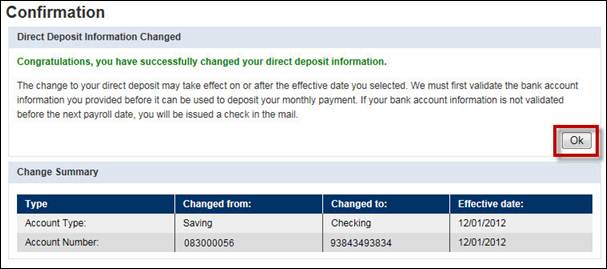

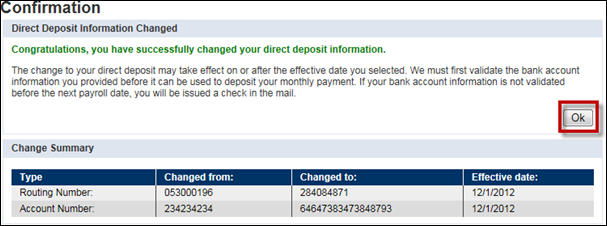

Step

5 — The screen that appears confirms the change to your direct deposit

information. Click ![]() to

view your pending direct deposit changes.

to

view your pending direct deposit changes.

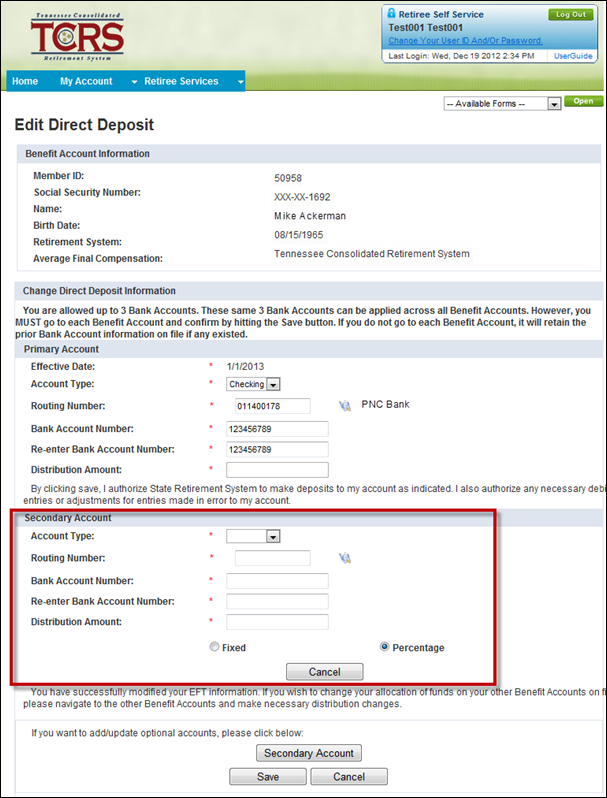

7.4 Adding a Secondary Direct Deposit Account

It is possible to have two bank accounts to which your benefit is deposited. For example, you may want a percentage of your benefit to go to a checking account and a percentage to go to your savings account. You must have a primary direct deposit account created before establishing a secondary account. Follow the directions in Section 7.1, Navigating to the Direct Deposit Screen, then follow the steps below to add a secondary direct deposit account. You must enter all required information on each screen. If you do not enter required information, you will not be able to successfully add a secondary direct deposit account.

Step 1 —Click the Change your direct deposit information click here link.

Step 2 — Click ![]() .

.

Step 3 — In the screen that appears enter the account type, routing number and bank account number. Select either Fixed or Percentage to distribute your benefit.

· If you select Fixed, a fixed dollar amount will be deposited to each account

· If you select Percentage, the percentage of the total benefit amount will be deposited to each account

Step 4 — Click ![]() to

verify the routing number entered matches the bank for the direct deposit.

to

verify the routing number entered matches the bank for the direct deposit.

Step 5 —Click ![]() .

.

Step

6 — The screen that appears confirms the secondary direct deposit

account will be added to your benefit account. Click ![]() to return to

the Direct Deposit screen

to return to

the Direct Deposit screen

Note: If needed, you can add a third bank account by following the steps from this section.

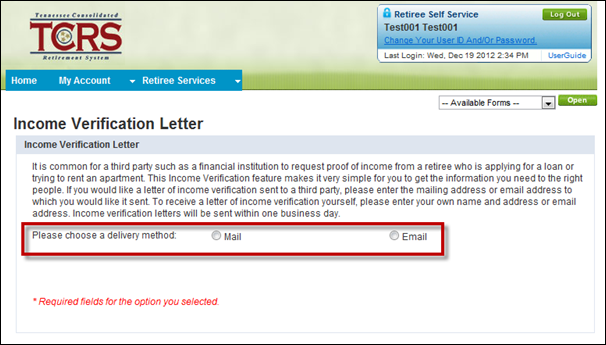

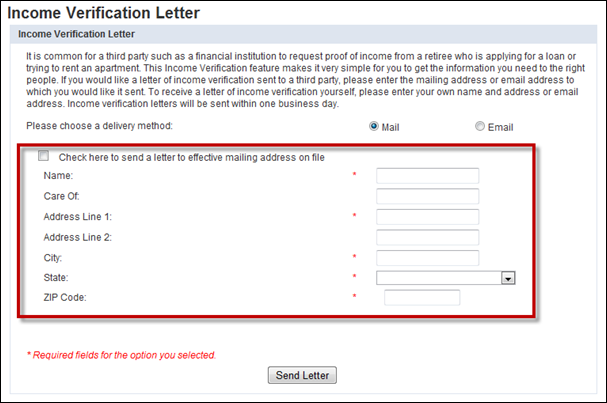

The Income Verification Letter screen makes it simple for you to provide proof of income to third parties. You must enter all required information on each screen. If you do not enter required information, you will not be able to successfully request an Income Verification Letter.

You must be logged into the Retiree Self-Service website to follow the steps.

Step 1 –- On the Home screen, either select Income Verification Letter from the Retiree Services drop down menu or click the Income Verification Letter link.

|

|

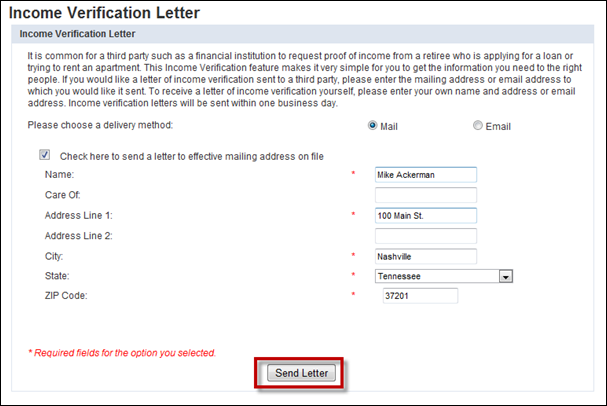

Step 2 —Select

the delivery method (Mail

or Email) by which your

letter should be sent.

Step 3 — If you selected Mail in the last step, enter the mailing address or select the checkbox to use the effective mailing address on record with TCRS. If you selected Email in the last step, enter your email address or select the checkbox to use the email address that is on record with TCRS.

Step 4 — Click ![]() .

.

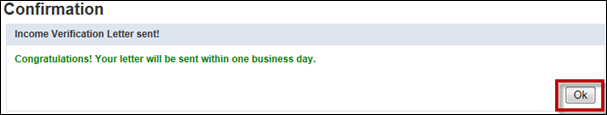

Step

5 — The screen that appears confirms that the letter has been sent.

Click ![]() to

return to the Income Verification Letter screen.

to

return to the Income Verification Letter screen.

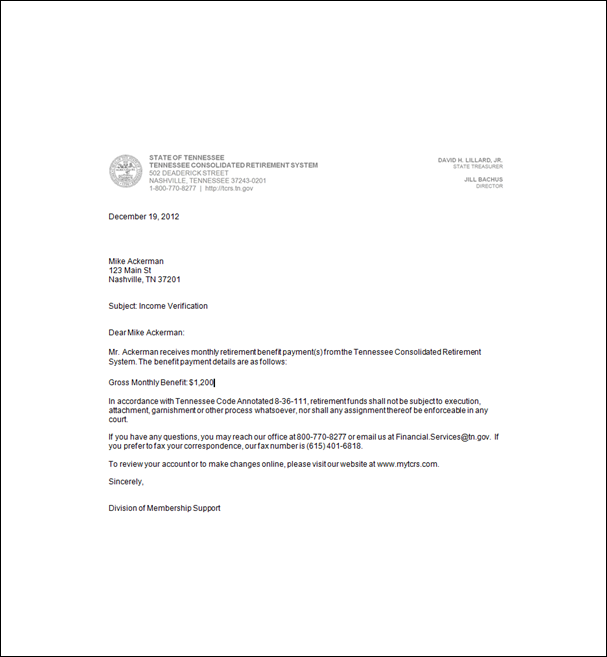

Note: The screen below shows an example of the Income Verification Letter.

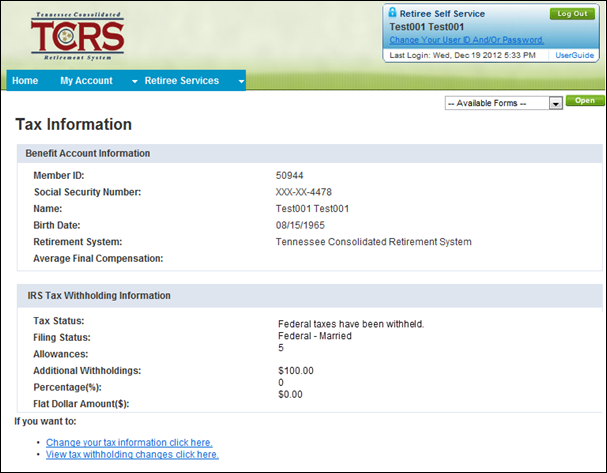

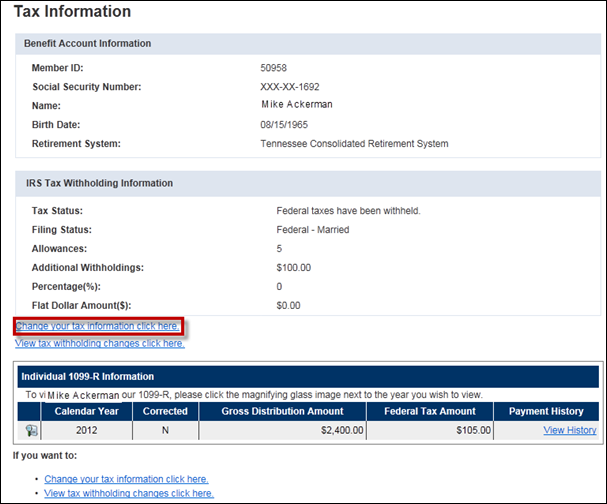

The Tax Information screen summarizes the federal taxes currently withheld from your benefit. On this screen, you can estimate how different withholdings change your net benefit amount. You can view and change your tax withholdings from this screen.

9.1 Navigating to the Tax Information Screen

The following steps describe how to navigate to the Tax Information screen. You must be logged into the Retiree Self-Service website to follow the steps in the sections that follow.

Step 1 –- On the Home screen, either select Tax Information from the My Account drop down menu or click the Tax Information link.

|

|

Step 2 — The Tax Information screen displays.

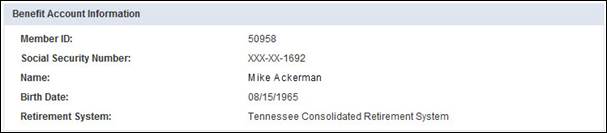

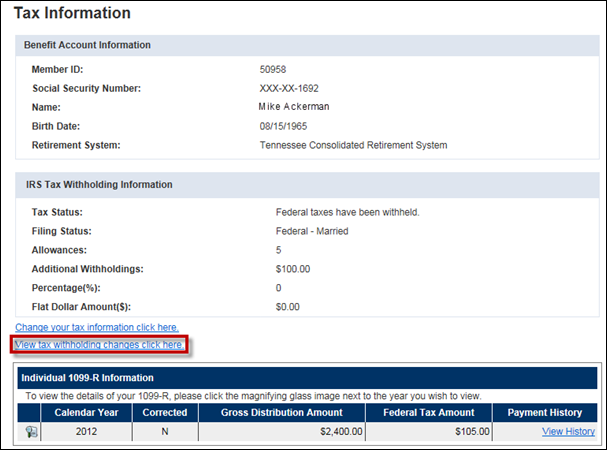

9.2 Viewing the Tax Information Screen

The Benefit Account Information section shows basic information regarding your benefit, including your member ID, partial Social Security Number, name, birth date and the retirement system from which the benefit is paid.

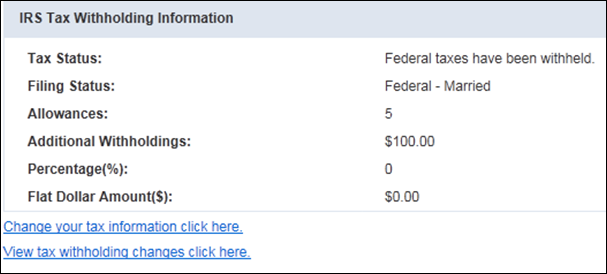

The IRS Tax Withholding Information section shows your current IRS tax details.

The Individual 1099R

Information section allows you to view your tax documents for any

individual year. To view a 1099R, click ![]() next to the year.

next to the year.

9.3 Changing Your Tax Withholdings

Using the Tax Information screen, you can change your tax withholdings. If you receive payments from multiple benefit accounts and wish to change the withholdings in each of them, you must do so individually.

Follow the directions in Section 9.1, Navigating to the Tax Information Screen, then follow the steps below to change your tax withholdings. You must enter all required information on each screen. If you do not enter required information, you will not be able to successfully change your tax withholdings.

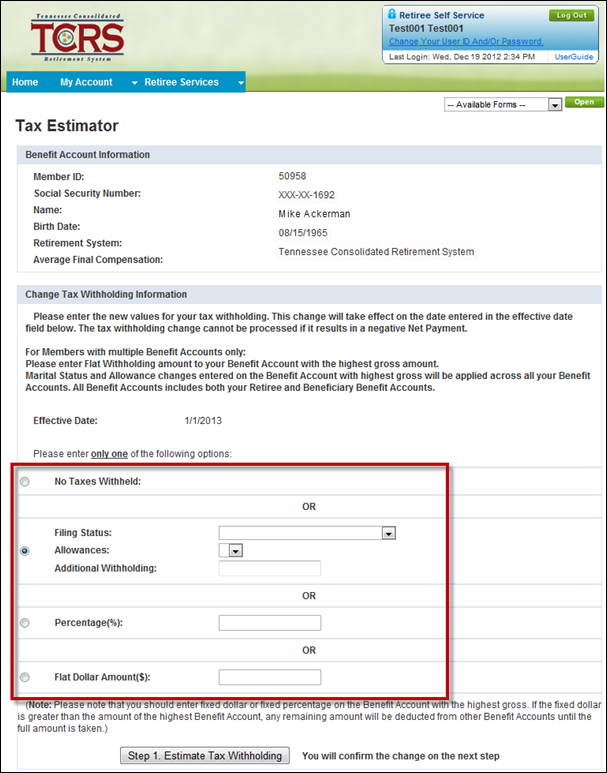

Step 1 —Click the Change your tax withholding click here link.

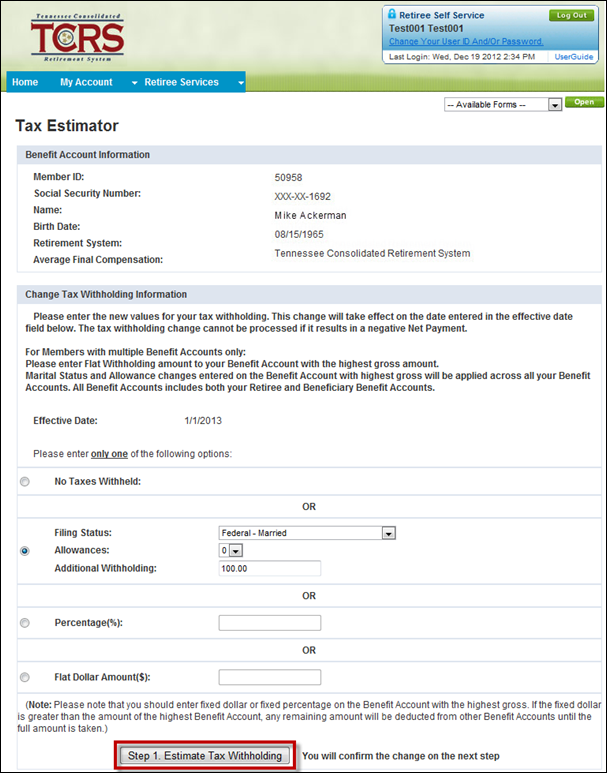

Step 2 — Enter your new tax details, such as no taxes withheld, filing status (i.e., Federal – Married, Federal – Single, Married, but withhold at higher single rate), allowances, additional withholding, percentage, or flat dollar amount.

Note: You must select the radio button before entering information.

Step

3 — Click ![]() to

see how your benefit payment will change based on your selection.

to

see how your benefit payment will change based on your selection.

Note: You tax withholding information will not change when you click this button. You will confirm the change on the next screen.

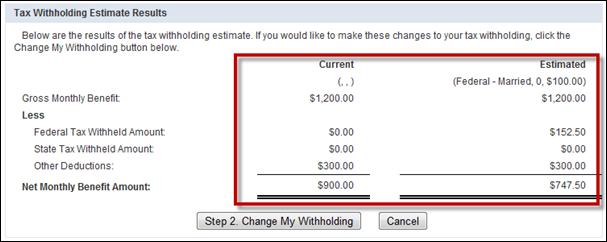

Step 4 — Your tax withholding estimate results display. Compare the current and estimated withholdings and the effect the new withholdings have on your monthly benefit amount.

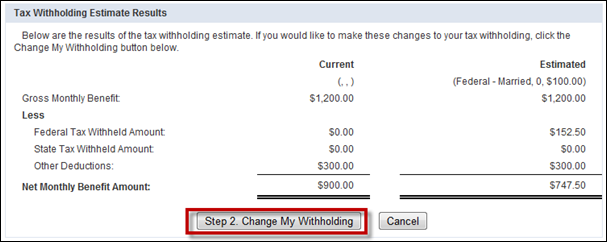

Step

5 —To accept the change to your tax withholdings based on the estimate,

click ![]() .

If you do not want to change the tax withholdings as shown, click

.

If you do not want to change the tax withholdings as shown, click

![]() .

.

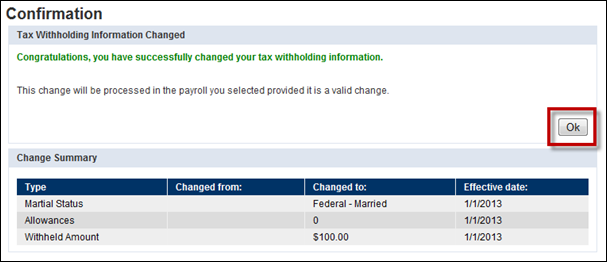

Step

6 — The screen that appears confirms the changes to your tax withholdings. Click

![]() to

view your tax withholding changes.

to

view your tax withholding changes.

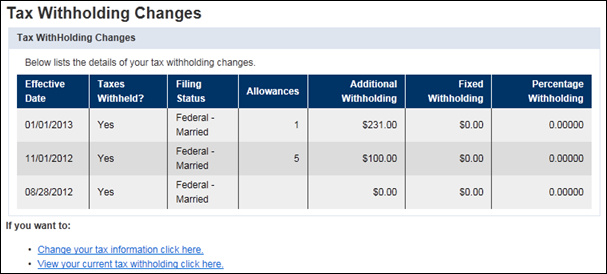

9.4 Viewing Tax Withholding Changes

Follow the directions in Section 9.1, Navigating to the Tax Information Screen, then follow the steps below to view your tax withholding changes.

Step 1 —Click the View tax withholding changes click here link.

Step 2 — The Tax Withholding Changes screen displays current withholding information.

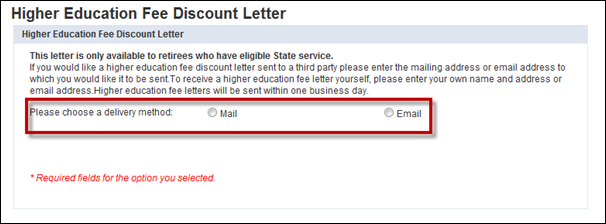

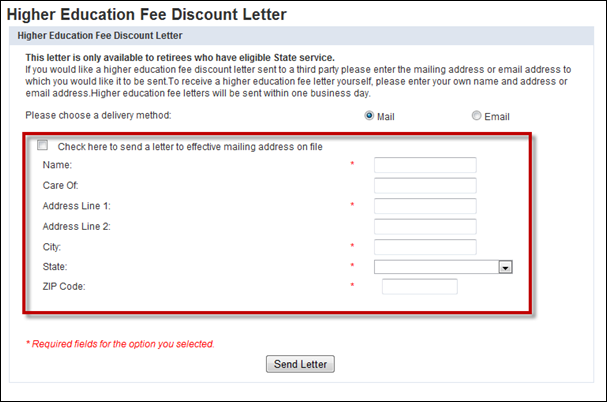

The Higher Education Fee Discount Letter screen allows you to request documentation for yourself and direct distribution to third parties to participate in either the Fee Waiver Program or the Fee Discount Program for eligible State employees. You must enter all required information on each screen.

Note: The Higher Education Fee Discount Letter is a certification form and does not certify that you are eligible for either program. If you do not enter required information, you will not be able to successfully request a Higher Education Fee Discount Letter. You must be logged into the Retiree Self-Service website to follow these steps.

Step 1 –- On the Home screen, either select Higher Education Fee Discount Letter from the Retiree Services drop down menu or click the Higher Education Fee Discount Letter link.

|

|

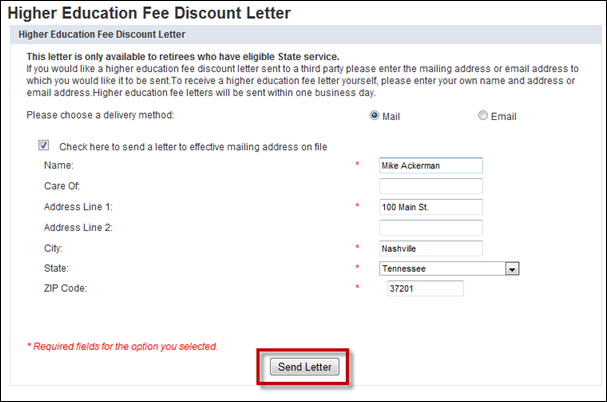

Step 2 — Select the delivery method (Mail or Email) for how you would like the letter to be sent.

Step 3 — If you selected Mail in the last step, enter the mailing address or select the checkbox to use the mailing address that is on record with TCRS. If you selected Email in the previous step, enter your email address or select the checkbox to use the email address that is on record with TCRS.

Step 4 — Click ![]() .

.

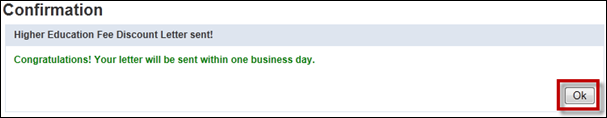

Step 5 — The screen

that appears confirms that the letter has been sent. Click

![]() to

return to the Higher Education Fee Discount Letter screen.

to

return to the Higher Education Fee Discount Letter screen.

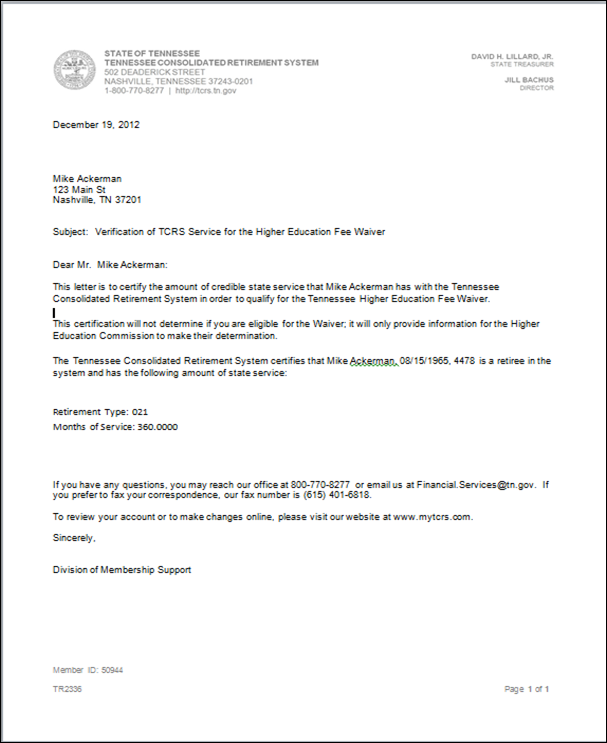

Note: The screen below shows an example of the Higher Education Fee Discount Letter.

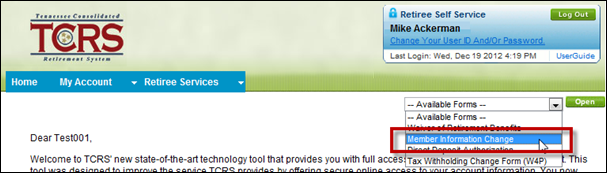

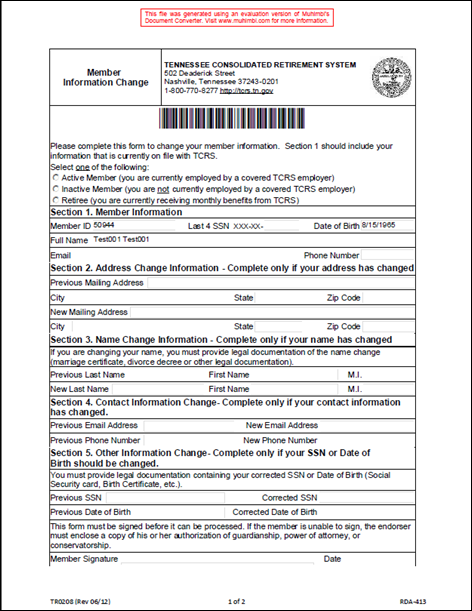

Using the Retiree Self-Service website, you can view and print electronic versions of the following forms:

· Waiver of Retirement Benefits

· Member Information Change

· Direct Deposit Authorization

· Tax Withholding Change Form (W4P)

After printing and entering information into the form, you must mail the form to TCRS for staff to process it.

Step 1 — The Forms drop down menu is available on the right side of the Home screen.

Step 2 — Select the form you want to view from the Available Forms drop down menu.

Step 3 — Click ![]() .

.

Step 4 — An electronic version of the selected form displays and is pre-populated with your information and a bar code that will allow TCRS to process it in a more efficient manner. This form must be printed and mailed to TCRS at this address: 502 Deaderick Street, Nashville, TN, 37243.

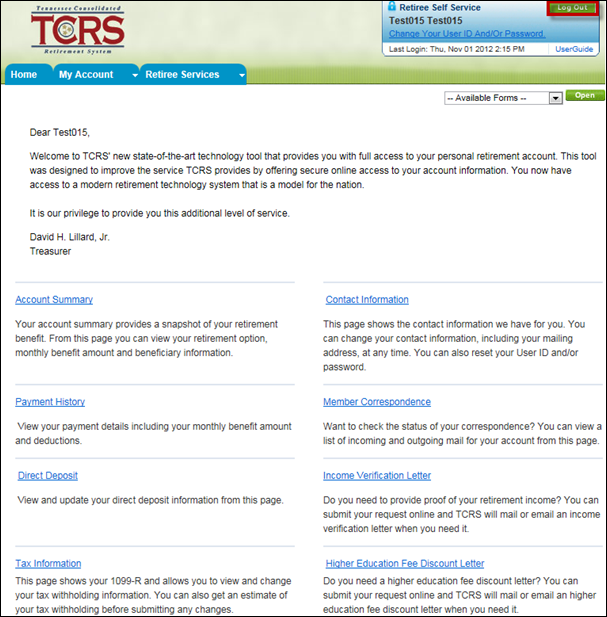

As a measure of security, the Retiree Self-Service website contains a timeout feature. If there is no activity (i.e., not taking actions such as saving, canceling, or confirming information) performed on the website for 15 minutes or if you close your browser window, you will automatically be logged out of the website and returned to the Login screen. In order to log back into the Retiree Self-Service website, re-enter your user ID and password and answer one of the security questions.

The logout feature allows you to leave the Retiree Self-Service website securely. When you are logged out, you cannot access any of the screens within the Retiree Self-Service website. The Log Out button appears in the top right-hand corner of every screen in the Retiree Self-Service website.

Step

1 — Click ![]() .

.

Document Control Information

Document Information

Document Identification |

5.2.2.4.2.1.1 |

Document Name |

Retiree Self-Service User Guide |

Project Name |

Tennessee Consolidated Retirement System (TCRS) Concord Project |

Client |

Tennessee Department of Treasury – TCRS |

Document Author |

Carrie Lewis |

Document Version |

vFINAL |

Document Status |

Final |

Date Released |

January 25, 2013 |

File Name |

TCRS Concord Project – Retiree Self-Service Guide-FINAL.docx |

Document Edit History

Version |

Date |

Additions/Modifications |

Prepared/Revised by |

v0.1 |

10/1/2012 |

Draft / Update |

Nisha Satayanarana, Carrie Lewis |

v0.1 |

11/29/2012 |

Draft |

Rebecca Friedman |

Final |

1/25/2013 |

Final review |

Rebecca Friedman |

Document Review/Approval History

Date |

Name |

Organization/Title |

Comments |

11/5/12 |

Lisa Brannen |

Deloitte |

Comments in document |

1/25/2013 |

Rebecca Friedman |

Deloitte |

Final review |